The Federal Revenue Service notified 393,678 MEIs (Micro Individual Entrepreneurs) who owe a total of R$2.25 billion. But taxpayers can still regularize their situations so that they are not excluded from the Simples Nacional program due to default.

“To avoid exclusion from Simples Nacional as of 01/01/2024, MEI taxpayers must settle all their debts, by paying in cash or in installments, within 30 days from the date of declaration of the exclusion period,” the Revenue warns in a note.

The exclusion period and suspense report was sent between September 11 and 14 to MEIs that had debts with the Federal Revenue Service or the Prosecutor General’s Office of the National Treasury.

Organization

Submitted documents can be accessed either through the Simei Services tab (the collection system for fixed monthly values of taxes covered by Simples Nacional), the Simples Nacional portal, through the e-tax domicile of Simples Nacional and the MEI, or through the e-portal -CAC, from Brazilian Federal Revenue website, using a specific access code, or via gov.br, Silver or Gold level account or digital certificate.

“Even if you have debts with the Federal Tax Service and/or the Public Prosecutor’s Office of the National Treasury and you do not receive an exclusion period, it is necessary for the MEI to settle your debts so that you are not excluded from the Simples Nacional law and, therefore, outside the scope of compliance with SEMAI, for this reason, Later,” the agency adds.

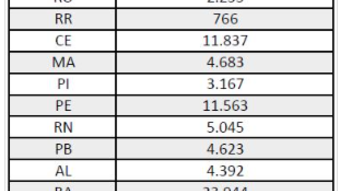

Number of notifications by states and DF

Conflict and guidelines

According to the IRS, the notification will be confirmed at the time of first reading, if the taxpayer accesses the letter within 45 days of the document being made available.

MEI that settles all outstanding issues within the above period will not be disqualified, and the disqualification period will be void. Therefore, he will continue under the Simples Nacional system and be included in the Simei, without the need for further action, even to appear before the Revenue Unit.

An MEI that wishes to appeal an exclusion clause must send an appeal addressed to the adjudicator of the Brazilian Federal Revenue Service and submit it online, according to the instructions on the Brazilian Federal Revenue Service website, Services menu > Defenses and Appeals > Exclusion of appeal from simples Nationalism.

MEI taxpayers who do not, within the statutory deadline, settle all debts listed in the accompanying pending report for the exclusion period will be excluded from Simples Nacional and will be automatically excluded from Simei as of 1/1/2024.

How to settle the situation

To repay or pay off outstanding debts in installments, simply access Simple people, the national portal Or MEI application.

Regarding debts that are already in active debt (charged by Office of the Attorney General of the National Treasury), payment must be made as follows:

• INSS debts must be collected in a DAS DAU (specifying document for active debts of the Union);

• ISS and ICMS debts must be collected directly in the form specified for the municipality or state responsible for the tax;

• DASN Simei can be delivered via the Simples Nacional portal or the MEI app.

• Share this news on WhatsApp

• Share this news on Telegram

Benefits of MEI status adjustment

• Maintain registration in Simples Nacional and listing in MEI;

• Stay insured with INSS, with guaranteed benefits such as sickness and retirement benefits.

• Avoid judicial debt collection.

• Ease of financing, loans, and opening an account in the name of the company. that it

• Calculate your debts in fixed amounts via PGMEI (DAS Individual Small Entrepreneur Generator Program).

If the MEI has doubts about problems or pending notifications, it is possible to access the messages sent by the Revenue at Simples Nacional Electronic Tax Domicile (DTE-SN) and at CAC electronic portal.

Consultation on outstanding issues can be conducted through PGMEI (full version), with a digital certificate or access code, in the option “Statement/Pending Consultation > Pending Consultation in Simei”. Or via the MEI application available on Android and iOS.

How to close a company

If the company is no longer in business, it is necessary to download the CNPJ. To do this, go to:

https://www.gov.br/empresas-e-negocios/pt-br/empreenedor/servicos-para-mei/baixa-de-mei.

Learn how Sebrae defines small enterprises, small businesses, and SMEs

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”

:strip_icc()/s02.video.glbimg.com/x720/12779213.jpg)

-1iynayaijg9pv.jpg)