IPCA+ Treasury bond rewards rise in line with US interest rates amid discussions about a possible spending pause

Leonardo Guimarães

Direct Treasury bond rates continue to rise sharply this Wednesday (27), with yields on inflation bonds reaching their highest level since April, following a rise in US interest rates. Yesterday, the yield on 10-year US government bonds rose to 4.55%.

Investors are following the financial scenario in the United States. The US government will need to freeze public spending if Congress does not vote on a temporary financing project to maintain investments after next Saturday (30).

Last night, the US Senate reached an agreement on the financing project, which is causing Treasury revenues to decline at the beginning of this Wednesday’s session. However, the House is trying to move forward with a conflicting measure, which only has support from Republicans.

Read more:

On the local scene, the rapporteur for tax reform in the Senate, Eduardo Braga (MDB-AM), announced another postponement to present his opinion on the matter, which was extended from October 4 to 20.

The justification for the change is the large number of amendments proposed by senators – to date, there are 241 amendment proposals – and increased demand for hearings in the Committee on the Constitution and Justice (CCJ).

Later, at 5:30 p.m., President Luiz Inacio Lula da Silva (PT) will meet with Roberto Campos Neto, President of the Central Bank. This is the first time since Lula’s election that the heads of the executive and monetary authorities have met. Finance Minister Fernando Haddad will also participate in the meeting.

The minutes of the latest meeting of the Central Bank’s Monetary Policy Committee (COPOM), which are considered tough, also help to open the interest curve. The document released yesterday showed that British Columbia leaders see no scope for accelerating interest rate cuts to 0.75 percentage points.

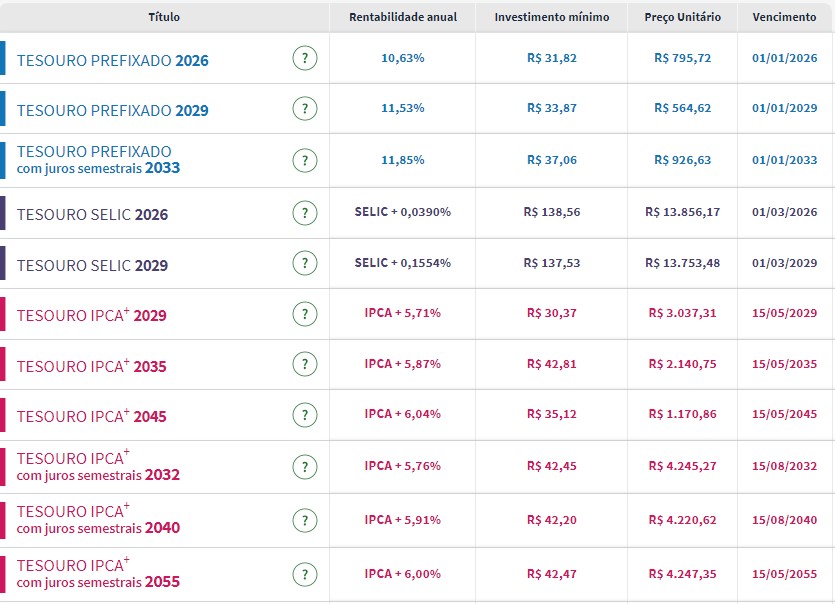

In Tesoro Direto, inflation bonds are offering the highest real yield since April 25 – and for the first time above 6% since May. In the first update of the day, at 9:34 a.m., the Treasury offered IPCA+ 2045 an interest rate of 6.04%. The real interest rate on IPCA+ 2055 Treasuries reached 6%, also a five-month high.

The lowest yield on inflation bonds is offered by the Treasury IPCA+ 2029, which pays 5.71% plus inflation and was yesterday at 5.45%. The real interest on notes due in 2032 jumped from 5.51% to 5.76%.

At previously fixed prices, prices also rose. The longest bond, which matures in 2033, achieved an annual return of 11.85% compared to 11.59% yesterday. The interest rate on 2029 Treasuries rose from 11.31% to 11.53%, while the interest rate on 2026 Treasuries rose from 10.45% to 10.63%.

Check the prices and rates of public bonds available for purchase at Tesouro Direto on Wednesday morning (27):

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”