Taesa stock (Tai 11) a rise of about 5% this Thursday (2) after the company announced that its board of directors had approved the distribution of dividends in a total amount of 523 million Brazilian riyals.

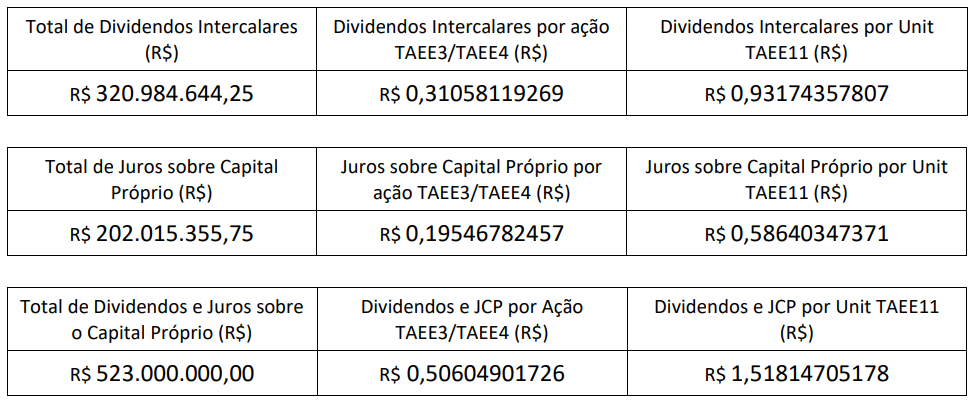

Of this total, R$320.984 million is interim dividend, based on preliminary financial statements prepared on September 30, 2021.

The remaining 202,015 million Rls refers to the interest payment on equity (JCP) based on the November 2021 balance sheet.

Interim dividend and interest on equity will be paid on December 29, 2021, based on the shareholding status on December 6, 2021. Effective on December 7, 2021, the shares and units will be trading “Dividend and Interest on Equity “”capital”‘.” in B3.

“Withholding income tax will be deducted from the amount to be paid as JCP, in accordance with current legislation, except for shareholders who are immune or exempt,” the electrician adds.

See details of TAEE dividends and JCP11 payments

Taissa Bonds

Taesa’s Board of Directors has also approved the eleventh issue of the simple bond, which is not convertible into shares, which will be subject to public distribution with limited efforts, under a confirmed underwriting guarantee.

The total issue amount will be R$800 million, at a unit cost of R$1,000. The maturity of the first series is three years and the second is five years.

He explained that “the money collected by the company through the repayment of debt securities will be used in the normal management of its business.”

Continue after advertisement

Buying opportunity? XP Strategist reveals 6 cheap stocks to buy today. Watch here.