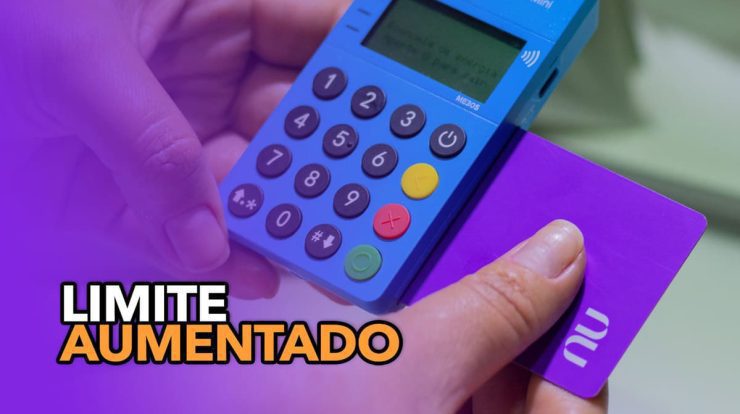

Many Nubank customers always have one recurring complaint about the bank: the difficulty in increasing their credit limit. In this way, users end up trying to find alternative ways to make fintech release more restrictions, which could become a reality with the launch of the new functionality.

So, if you want an extra chance of getting bank approved, see below how to join the resource that can give you that power. Don’t miss any important information!

An upper limit for those who adhere to Nubank’s open finance

Thinking of customers whose requests for credit are constantly being turned down, he told Nubank that the chances might improve if users start sticking with Open Finance. By this means, both those who want more limits and those who want to agree to start using credit can benefit.

Basically, Open Finance is a system for sharing data with other fintech organizations to assess their financial behavior with other banks and to transfer the advantage, which is relatively new. In Nubank’s case, specifically, customers have already been able to use Open Finance since September.

By accessing consumer information, fintechs can understand what their financial behavior is like to finally enable them to overcharge. In other words, it is a system that collects all the data from different organizations in just one place, as well as making payments in different banks through Nubank (only redirected to other platforms) and monitoring all movements.

Check out some of the advantages for those who share six pieces of data:

- safety: First, it should be noted that data sharing is secure, as the tool is directly managed by the central bank;

- credit limit: Information collected from other banks can help with the credit limit process;

- Customized products: With a better understanding of the customer’s payment habits, as well as his own, the organization can offer products that match the individual user profile of each;

- Financial Supervision: It is easy to control all accounts in one place, especially without having to pay extra for it.

See also: Earn up to R$1,500 in Nubank by doing this simple action

How do you join the method?

If you are interested in joining Nubank Open Funding, check out the simple step-by-step instructions below:

- First, open the fintech app (Android: https://bityli.com/vENGmP or iOS: https://bityli.com/yrlJpS🇧🇷

- Then tap on the top left corner menu, which contains the photo icon;

- When the help window opens, click on the “Open Funding” option, then on “Continue” and then on “Share”;

- Finally, inform the organization you want to share the data with and click Continue.

After selecting the bank you want to join the method, the application of the selected institution will open for the user to confirm the data sharing with a password or fingerprint. Then, you just need to confirm the action to complete the transfer and the app will redirect the customer to Nubank again.

See also: Learn how to earn more limit on Nubank by sharing data; paying off

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”