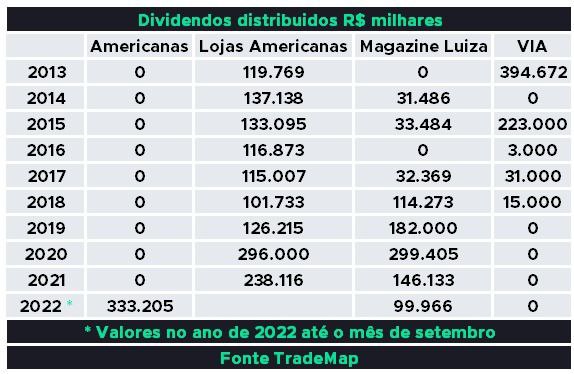

The trio of billionaire Americana shareholders (Amer 3), Jorge Paulo LehmannAnd Marcel Telles And Carlos Alberto Secubera He earned nearly R$100.3 million in earnings from the retailer through September 2022, the year that marked the highest dividend paid by the company in the decade.

Scan got Infomoney Next to TradeMap Center He pointed out that Americana distributed 333.2 million Brazilian riyals in cash dividends until the third quarter of last year. The trio of 3G Capital founders currently own 30.13% of the company’s shares.

The survey by Einar Rivero, TradeMap’s Chief Commercial Officer, takes into account the corresponding amount of proceeds that have already been cashed out — that is, already withdrawn from the company’s funds, even though they may not have yet fallen into the investor’s account.

The payment of dividends by Americana in recent years may be another point of interest in the crisis plaguing the retailer. That’s because the company’s former CEO Sergio Real had already warned that some balance sheets would need to be rebuilt to reflect the R$20 billion accounting deficit.

A lawyer experienced in the corporate sector notes that, most likely, part of this proceeds should not be distributed, since there is a high chance that the “drawn-out” operations have inflated the company’s net income.

Continue after the announcement

However, the professional warns, there is no consensus about what path shareholders who received the company’s earnings “with good intentions,” that is, who have no idea what the problem is with the company’s balance sheet, can take. Another problem for the following chapters of the crisis.