Attention workers Who has a birthday in April! Hey Service Life Guarantee Fund (FGTS) It introduces big changes for 2024, mainly including the Christmas draw method. This change aims to provide greater financial flexibility, allowing the annual withdrawal of a portion of the accumulated fund.

How does the FGTS Birthday Draw work?

road Birthday loot It was created to facilitate access to a portion of FGTS resources during the worker's year of birth. Depending on the accumulated amount, it is Possibility of withdrawal between 5% and 50% of the balance plus an additional fixed installment. This access can be crucial for those who need to pay off debt, make investments, or bolster their emergency fund.

What are the effects of changes to Christmas withdrawal?

When you choose to opt out for Christmas, it is It is important to highlight The worker loses the right to completely withdraw from the FGTS in the event of unfair dismissal, however, he reserves the right to a 40% termination penalty. Therefore, it is necessary to carefully evaluate this option.

How does the 50% FGTS rate work?

The FGTS annual withdrawal method, known as the Birthday Withdrawal, determines the amount to be withdrawn based on a rate applied to the total balance of the worker's accounts, plus an additional portion, according to the table below:

- Balance range limit (in Brazilian Real):

- Up to 500.00: interest rate 50.0%, additional installment –

- From 500.01 to 1,000.00: interest 40.0%, additional installment 50.00

- From 1,000.01 to 5,000.00: interest 30.0%, additional installment 150.00

- From 5,000.01 to 10,000.00: interest 20.0%, additional installment 650.00

- From 10,000.01 to 15,000.00: interest 15.0%, additional installment 1150.00

- From 15,000.01 to 20,000.00: interest 10.0%, additional installment 1,900.00

- Above 20,000.01: interest rate 5.0%, additional installment 2,900.00

For example, a worker with R$1,000 in FGTS can withdraw R$400.00 (at 40%) plus R$50.00 (extra premium), for a total of R$450.00 in the Christmas draw.

Implementations facilitated by Caixa

In order to improve the user experience, Caixa Economica Federal Improved withdrawal system, which can now be implemented directly through FGTS application. a The upgrade simplifies the transaction processensuring safety and practicality for the user.

What is the expected economic impact of the new FGTS rules?

The changes introduced are expected to inject dynamism into the Brazilian economy, especially with the issuance of withdrawals for April birthdays and other changes planned for the following months. The additional money in circulation should help not only in post-pandemic economic recovery, but also expand workers' financial capacity and stimulate consumption and investment at the national level.

How do you prepare to use your Christmas spoils effectively?

- Check the total available balance in FGTS through the official app.

- Evaluate your financial needs before choosing to withdraw.

- Plan the use of resources strategically to achieve maximum benefits.

- Stay informed of the withdrawal dates and follow the procedures indicated by the official Caixa Econômica Federal channels.

at recent days Changes to FGTS This is a critical milestone for Brazilian workers, marking an important step towards financial independence. However, every financial decision must be made with caution and proper planning.

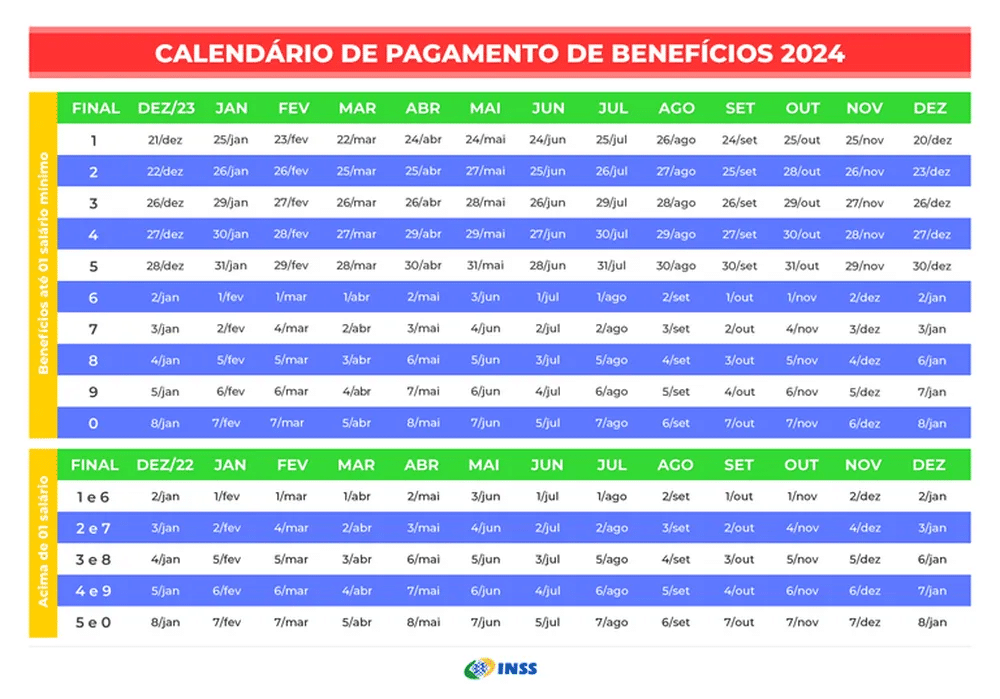

FGTS 2024 Birthday Draw Calendar

Check FGTS using CPF on your cell phone

To check your FGTS balance over the phone, simply call 0800 726 0207. When you answer, you will be asked to provide your date of birth and NIS number to access your FGTS balance information quickly and efficiently.

In addition, you can take advantage of the text messaging (SMS) service of Caixa Econômica Federal to receive updates about your FGTS balance directly on your cell phone. To do this, you need to register your cell phone number in your account, and whenever there is a movement of deposits, you will be notified via text message.

These options provide simple and convenient ways to track and monitor your FGTS balance, ensuring you always have access to your finances.

How do I know if I have the FGTS to receive it

Digital Towing is a new service that provides more convenience, speed, security and convenience for FGTS towing.

Through the FGTS application, you can check the amounts available for withdrawal and request a refund, indicating the account you hold in any bank.

This method is completely digital, eliminating the need to go to a bank branch. This functionality has been available since February 2020, making access to your FGTS resources easier.

How to access Caixa Tem via web browser?

To access Caixa Tem via your web browser, follow these steps:

- Open your favorite web browser (such as Google Chrome, Mozilla Firefox, Safari, Microsoft Edge).

- In the address bar, type the following URL: https://acessar.caixatem.com.br.

- Press “Enter” or click the right arrow to access the site.

- On the Caixa Tem home page, you will find options to log in or register, depending on whether you already have an account or not.

- If you already have an account, click “Sign in” and enter your CPF and Caixa Tem password.

- If this is your first time logging in, click Register and follow the instructions to create an account.

- After logging in, you will have access to the features offered by Caixa Tem, such as balance inquiries, statements, bill payments, transfers and other services.

Always be sure to access the official Caixa Econômica Federal website to ensure the security of your financial information.